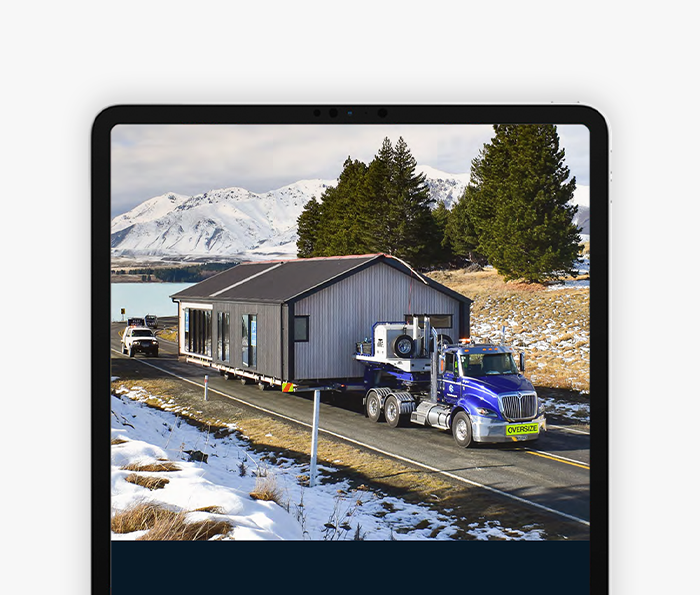

Your dream home, made easy

At Genius Homes, we build a range of high-quality prefab houses in our specialised factory. We deliver throughout the South Island, offering fast turnarounds, cost-effective pricing, and a seamless experience.

Our designs

With our wide range of house plans, you can easily find one to complement your lifestyle. Get started with the dream home finder tool, download the digital catalogue, or ask about custom designs.

Dream big, build smart

Want to know why you should build your new home with us? Find out below.

Why choose a prefab home?

The controlled nature of our prefab approach provides a streamlined building experience, fewer delays, and predictable costs.

The prefab building process

Our team will guide you every step of the way, update you on progress, and handle all the project management.

Funding your prefab home

Our experienced team has all the cost saving tips and financing solutions you need, including fixed-priced contracts.

Making Your Dream Home a Reality

Want to learn more about Genius Homes? Explore the endless possibilities with prefab homes and hear real stories from real customers.

/2021%20Catalogue/Updated%20Catalogue%20info/Exterior/image0.jpeg)