The financial benefits of farm homes

Providing farmworker accommodation has many benefits for both workers and landlords, but there are also many financial benefits that can be enjoyed when investing in farmworker accommodation too.

Most investments in your farm increase its value. From maintaining fences to upgrading hay or implement storage sheds, any prospective buyer can class these upgrades as value-added improvements - or even upgrades they will not have to make themselves. For a farmer looking to get operational as soon as possible, without investing their own time and money on ticking off those jobs, these are going to be big selling points.

The same can be said of staff housing. These investments can attract good workers by offering something other farmers may not be able to, and they can even be used as extra income streams for farm stays. With New Zealand tourism being a major earner for this country, there is a chance for farmers to tap into this without a lot of extra effort.

Farm accommodation has several other financial benefits. For example, it's likely to be classed as capital expenditure and can, therefore, be classed as tax deductible. It's important to note that buildings no longer benefit from building depreciation. The 2010 budget changed the rate of building depreciation from 2% to 0%, owing in part to the fact that houses have been increasing in value. However, some farm buildings, such as barns and other property may depreciate. In a 2018 tax working group this topic was revisited and recommendations were made to reinstate the depreciation for commercial buildings (such as farm buildings), however standalone residential buildings were seperate. If applied this may mean a building such as this 5 bedroom staffing complex could possibly become depreciating, whereas this 4 bedroom manager's home would not.

Farm accommodation has several other financial benefits. For example, it's likely to be classed as capital expenditure and can, therefore, be classed as tax deductible. It's important to note that buildings no longer benefit from building depreciation. The 2010 budget changed the rate of building depreciation from 2% to 0%, owing in part to the fact that houses have been increasing in value. However, some farm buildings, such as barns and other property may depreciate. In a 2018 tax working group this topic was revisited and recommendations were made to reinstate the depreciation for commercial buildings (such as farm buildings), however standalone residential buildings were seperate. If applied this may mean a building such as this 5 bedroom staffing complex could possibly become depreciating, whereas this 4 bedroom manager's home would not.

As always, it's best to consult your accountant before making any purchases based on tax or investment decisions.

If you are going to tap into farm home investments, and the financial benefits this may bring to your farm then there are a few things you will need to consider.

Legal tenancy requirements

You are considered a landlord if you have houses on farm rented by farm staff or private tenants. This means you're bound to certain obligations under the Residential Tenancies Act and the Housing Improvement Regulations Act, summarised by TenancyServices.govt.nz. The purpose of the Housing Improvement Regulations is to ensure properties are warm, dry, safe, and sanitary.

A service tenancy is the correct agreement when the accommodation is linked to employment. You can find a Service Tenancy Agreement template on the Tenancy Service website.

Before staff move in, a landlord must complete a property inspection with the new tenants and note any existing damage. The landlord must rectify anything that will impact on the tenants' lives such as:

- Identify and fix hazards such as broken windows and holes in walls.

- Check and maintain smoke alarms.

- Ensure the house can be kept warm.

Insulation

From 1 July 2019, it’s compulsory for all tenanted homes - including sleep-outs - to have underfloor and ceiling insulation which meets the required standard where it can practically be installed. Luckily for you all Genius Homes houses already meet the requirements for insulation.

Smoke alarms

All tenanted houses (including caravans and sleep-outs) are legally required to have working smoke alarms. These must be either photo-electric (long life) or hard-wired and installed according to the manufacturer’s instructions. As a landlord you are required to supply and maintain smoke alarms. Again, all Genius Homes houses are fitted with compliant smoke alarms.

It's important to note that all farm accommodation needs to meet the requirements of the Healthy Homes Legislation and also the Residential Tenancies Act.

Outside of your obligations as a landlord there are tax obligations that must be met in terms of payroll if the worker is to receive the house as part of their employment benefits.

Tax obligations (worker)

Farming Growth, specialist rural accountants based in Hastings, give the below example of how farm accommodation rentals can be factored into the worker's PAYE:

John works on a farm as head shepherd and receives a salary of $45,000 as well as a free house. The house is 30 minutes from town, of average condition and 3 bedrooms. Equivalent houses in the district are rented for $200 per week. He has nominated the tax code M on his IR330 Tax Code declaration form. He is paid weekly, receives a non-taxable allowance of $20 per week, and is a member of KiwiSaver at a deduction rate of 3%.

| Salary divided by 52 weeks | $865.38 |

| Market value of free rent | $200.00 |

| Gross Weekly Income | $1,065.38 |

| Less | |

| PAYE | ($200.18) |

| KiwiSaver Employee deductions | ($31.96) |

| Plus: | |

| Non Taxable Allowance | $20.00 |

| Less: | |

| Rent | ($200.00) |

| Net Weekly Payment | $653.24 |

This does mean that it's important to have your farm worker accommodation appraised to ensure it represents a fair market value.

Farm worker accommodation provides your staff with a healthy, convenient and rewarding bonus to working for you. From accommodation blocks to individual homes, Genius Homes has a large variety of designs to add value to your farm. Should you choose to sell your farm in the future these units add value to the property and give your farm an additional feature to make it more enticing. The capital expenditure of buying the farm house can also help when it comes to having your tax obligations accounted for in that financial year.

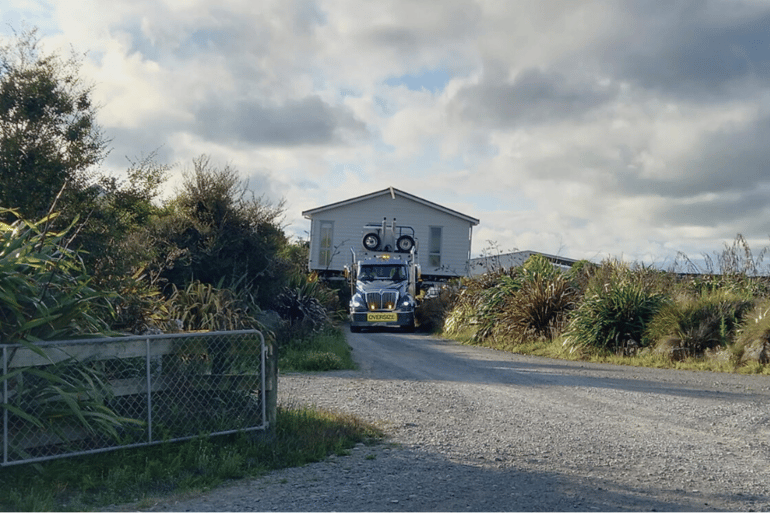

Having spoken to your accountant about the potential benefits of investing in farm worker accommodation the next best thing to do is talk to a member of the Genius Homes team. We can conduct a free site visit to ensure that a prefabricated home can be delivered to your site and talk through some of your options.